- Used by 3,500 people, 3/4 of the economically active people in Korea

- Drastic growth to 3Q transaction of 17.9 tril won due to prolonged COVID pandemic

- Effort to expand the non-face-to-face investment as a fintech leader

- Using technologies such as AI and machine learning to lead the Asian market

Currently, the world economyis in turmoil due to the prolonged COVID-19 outbreak. However, IT, content, andbio companies located in Pangyo did well in domestic and overseas markets, andthis gives hope to related industries and many startups. In this issue, welooked at Kakao Pay's major activities in 2020, showing their real skills andmaking amazing achievements even in harsh conditions.

As the demand for non-face-to-face paymentincreased due to the pandemic, the sales of Kakao Pay located in Pangyo also soared. Kakao Pay's transaction amount in thefirst half of this year reached 29.1 trillion won, and the transaction amountof online payments in 2Q increased by more than 67% YoY. Kakao Pay's financialservice transaction amount recorded three times higher YoY and 49% higher QoQ.Also, Kakao Pay's 3Q transaction amount of this year recorded 17.9 trillionwon, which is an increase of 38% YoY.

CEO Ryu Young-jun of Kakao Paysaid, "Amid the increasing preference for non-face-to-face payment methodsdue to the prolonged COVID, Kakao Pay is now widely used not only online, butalso in affiliated franchise stores and overseas, and the payment transactionamount increased by 72% compared to the same period last year." About thechanges in the fintech market and the role of Kakao Pay in the post-COVID era,Ryu said, “Due to the low interests in banks accelerated by the spread ofCOVID-19, the financial market is changing from saving money in banks toinvesting, and the needs for non-face-to-face transactions are also increasing.As the leader that opened the fintech market in Korea, Kakao Pay will try itsbest to expand the non-face-to-face investment method.”

Kakao Pay is a fintechsubsidiary of Kakao, launched in April 2017 that has led the transition to the“wallet-free society” where economic activities can be carried out anytime andanywhere with a smartphone. Especially since 2014 when the mobile simplepayment system was first launched in Korea, it has achieved remarkable growthby providing innovative life finance services that relieve the inconvenience ofconventional financial activities such as online and offline payments,remittances, membership, bills, and authentication.

Starting with investmentservices in November 2018, Kakao Pay introduced specialized financial serviceslike integrated and credit assessments, insurance, and loan comparisons in2019, expanding its business areas to provide open financial services toanyone. Also, in February 2017, it attracted a 200-million-dollar investment fromAnt Group, the parent company of the global payment platform Alipay andconcluded the strategic partnership. It is now forming various cooperation insecuring growth engines in the Korean market, laying a bridgehead for overseasexpansion, and developing the mobile financial ecosystem.

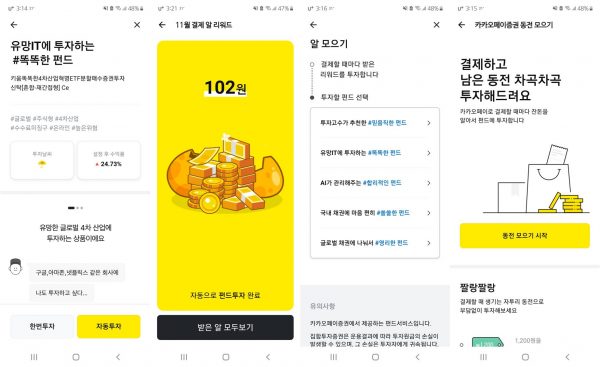

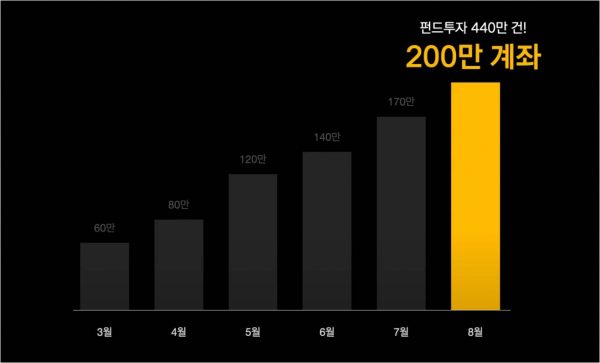

In February this year, it hasbecome the largest shareholder of Baro Investment and Securities, changed thecompany name to Kakao Pay Securities, and entered the securities industry asthe first techfin company. Kakao Pay Securities started with a new idea ofconverting Kakao Pay money which is a prepaid e-payment method into securitiesaccount, providing various benefits and convenient services, and the number ofaccounts is now rapidly increasing.

(Over two million Kakao Pay users are using the securities account service)

Along with this, it opened five carefully selected fund products in the Kakao Pay Investment service to diversify its portfolio of investment products, and it is making a new wave of adventurous investment by “collecting coins,” which automatically invests in the designated funds with the remaining change after payment, and “collecting eggs,” which invests rewards received after payment.

CEO Ryu said, “In the longterm, based on Kakao Pay's big data and AI technology accumulated throughvarious services, we are planning to expand the user-centered investmentservice with new investment solutions and advisory asset allocation servicesthat can help users with less investment experience to obtain profits with funand ease. Moreover, we are also thinking about non-face-to-face-basedinnovative asset investment service by using robo-advisors.”

In addition, Kakao Pay ispreparing to establish a digital non-life insurance company based on thecountry’s best techfin technology and platform influence with Kakao, and ispreparing products to eliminate insurance blind spots and protect users fromeveryday risks. Kakao Pay is planningto introduce products to eliminate insurance blind spots and protect users fromeveryday risks by making a digital non-life insurance company. On theother hand, Kakao Pay acquired stakes in the insuretech platform startup INBYUin July 2019 and secured management rights, laying the groundwork for enteringthe insurance industry. Since the launch of the insurance service in October2019, it has been introducing reasonable insurance products like travelers’insurance, sports insurance, and mobile phone insurance that have a lowerbarrier of entry and that can help people to be prepared for small and bigrisks in life.

With this, Kakao Pay startedsupporting payment services in the Apple App Store for the first time as asimple payment service last year, and it is currently providing paymentservices through Kakao Pay at overseas affiliates such as Google Play, YouTube,Ali Express, and iHerb. CEO Ryu added, “We plan to continuously expand onlineand offline affiliates so that users can use various financial services withKakao Pay alone.”

To create synergy between the Kakao community, Kakao Pay is pursuing cooperative work by opening up various possibilities. In May, it cooperated with Kakao Bank to streamline the account linking process and started linking “Easy Account Link” and “Asset Management” for integrated management of financial assets. CEO Ryu delivered the changes in the financial life and future directions that Kakao Pay has made in “if(kakao) 2020” conference on Nov. 19 and announced that he will work continuously to lower the inconveniences in payment with Kakao Pay to zero.

He ended the interview by saying, “Kakao Pay has a development culture that pursues openness and sharing, horizontal communication, suitability of the staff in charge, autonomy, and diversity, and we are striving to find talented people. Kakao Pay's innovative corporate culture DNA is being developed by talented developers who are qualified, who can communicate, and who are willing to work with colleagues to solve problems. This is the growth engine that Kakao Pay can sustain new challenges.”

(if(kakao)2020 Conference / Finance with Peace of Mind: 01100193500) / Session by Ryu Young-jun, the CEO of Kakao Pay)